statute of limitations on car repossession in nc

Physical confrontation with oral protest. The 4 year statute of limitations is the deadline for filing a lawsuit.

![]()

Repossession Why It Happens What You Can Do And Your Rights Before During And After Repossession

Up to 15 cash back The statute of limitations in Illinois is 10 years for a breach of written contract and 5 years for a breach of oral contract.

. North Carolina law gives creditors the right to repossess various items such as consumer goods automobiles furniture and machinery when a buyer has become delinquent. In a right to cure state you have a certain amount of time to pay your past-due debt by state law. What is the statute of limitations in regards to car repossession in NC.

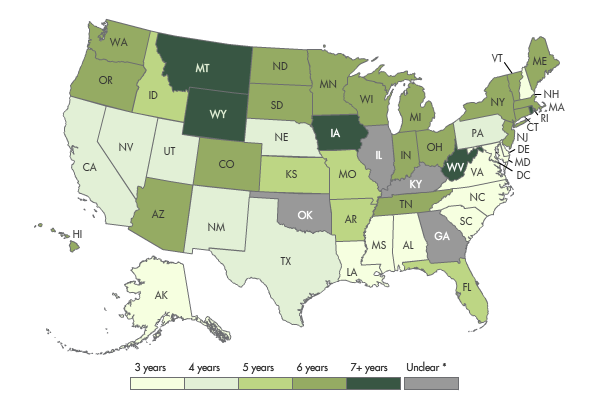

Debts that are secured with an asset such as car loans come with a statute of limitations thats usually between three to six years. A negative notation on your credit report may remain for up to seven years if your loan is delinquent or up to 10 years if the notation is a vehicle repossession. The statute only applies to the.

The right of repossession does not require a lawsuit so there is no deadline on the right of repossession. In most cases this means on the date of the last payment made. The statute of limitations becomes effective on the date of the last activity on an account.

North Carolina General Statute 1-5216 requires that personal injury lawsuits be brought within three years of the action happening. North Carolina has that right for certain foreclosure matters but not for motor. Yesterday the repo man came looking for my car but did not take it after I told him my situation he just shook his head.

Automobile Repossession In Illinois. We sold it and never. The three-year time limit begins to run on the date your.

The statute of limitations is the time period a creditor can still sue you for debts. Creditors only have a certain duration of time they can attempt to collect a debt by suing you. In two months it will be five years from the default date.

In North Carolina the statute of limitations for automobile loans installment loans credit cards and promissory notes is three years from the date of the last payment or charge. Essentially- the Repo man cant break into your garage to retrieve a vehicle although they can tow a car parked in your driveway or on the street. Statutes of Limitations Create.

Statute Of Limitations For Debts Credit Cards Judgments

The Laws On Collecting On A Defaulted Car Loan In North Carolina

How Late On Car Payment Before Repossession Lendedu

Repossessions Know What To Expect Before During And After Consumers Law

The Laws On Collecting On A Defaulted Car Loan In North Carolina

Information On Car Repossession Laws In North Carolina

Statute Of Limitations On Debt Collection By State Lexington Law

Car Repossession Attorney What Are My Rights Charlotte Nc Lawyers

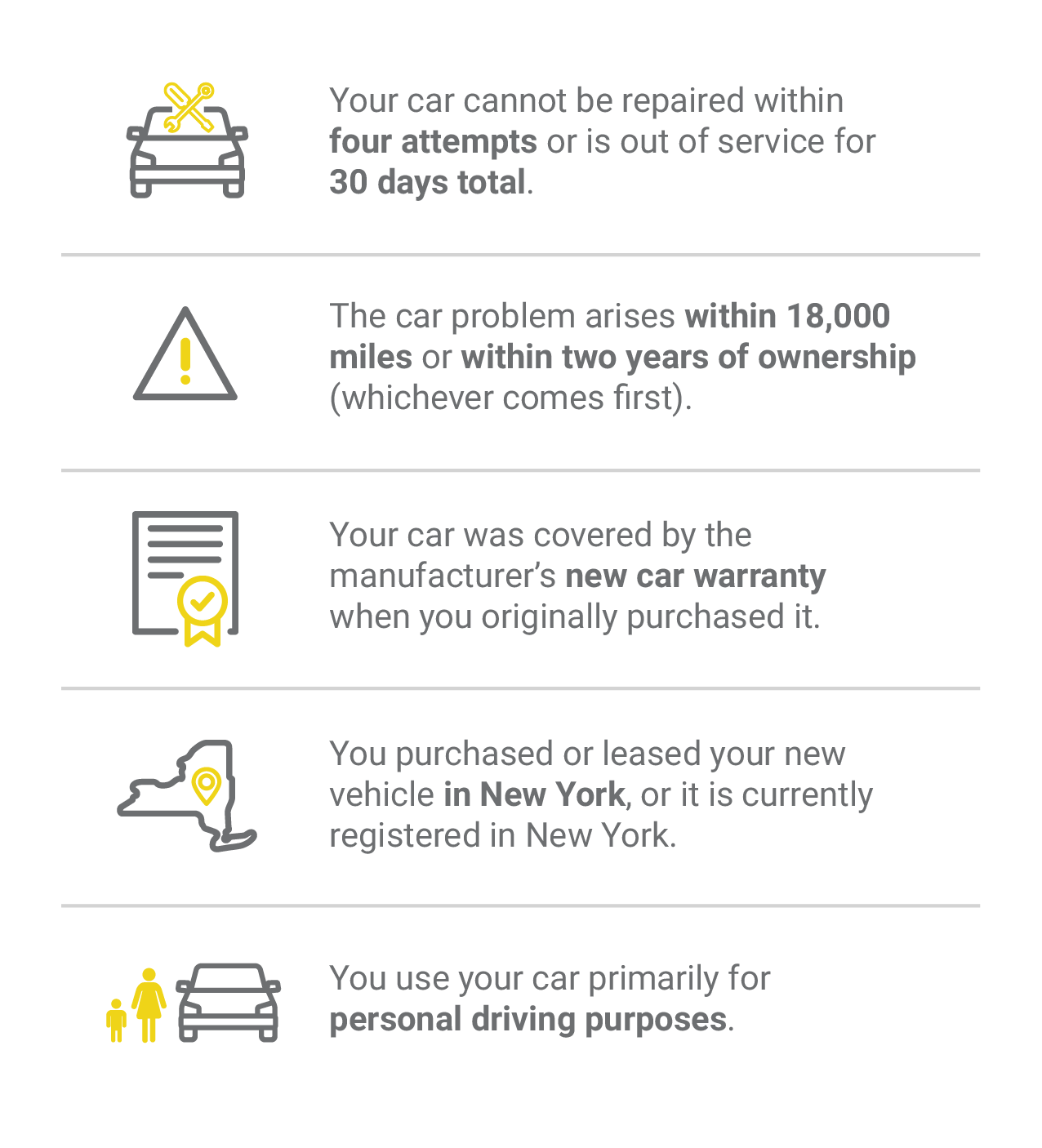

Ny Lemon Law Information Lemon Law Requirements In New York Free Ny Lemon Law Case Evaluation

How To Defend Yourself In A Car Repossession Deficiency Claim

How To Answer A Summons For Debt Collection In Texas 2021 Guide Solosuit Blog

How To Hide Your Car From Repossession

What To Do After An Automobile Accident In North Carolina Martin Jones Pllc

What Happens When Your Car Is Repossessed In Pa Consumers Law

What Is The Statute Of Limitation For A Car Loan

Late On Car Or Truck Payments North Carolina Repossession Law And What You Need To Know