cap and trade vs carbon tax canada

In 2021 more than 21 of global GHG emissions were. Dividend stocks have seen a massive increase in popularity lately.

Since 1937 our principled research insightful analysis and engaged experts have informed smarter tax policy at the federal state and global levels.

. Additional costs on GHG emissions can lower competitiveness of fossil fuels and accelerate investments into low-carbon sources of energy. QQQ tracks a modified-market-cap-weighted index of 100 NASDAQ-listed stocks. Find the latest business news on Wall Street jobs and the economy the housing market personal finance and money investments and much more on ABC News.

The Tax Foundation is the nations leading independent tax policy nonprofit. Carbon emission trade - allowance prices from 2008. A growing number of countries raise a fixed carbon tax or participate in dynamic carbon emission trading ETS systems.

Carbon tax and replicating this policy across the globe. In British Colombia Canada the main proceeds of Carbon pricing go directly to firms households making the carbon tax quite popular amongst important political constituencies. That comes as the volatile market continues for TSX investors.

SPLG vs SPY SPLG vs IVV SPLG vs VOO SPLG vs SCHX SPLG vs IWB Related ETF Channels. The Carbon Tax Center was founded in 2007 on the belief that the most direct path to decarbonize the world economy lay in enacting a robust US. A dozen years on we hoped to expand our program around a new synthesis.

To improve lives through tax policies that lead to greater economic growth and opportunity. By contrast Australias short-lived carbon tax 2012-14 suffered from lack of political understanding and poor communication about who benefitted from it. The SPTSX Composite Index is up just 05 year to date as of.

For over 80 years our goal has remained the same. Large Cap North America. A Green New Deal funded.

QQQ Factset Analytics Insight. QQQ is one of.

Climate Income A K A Carbon Fee And Dividend Citizens Climate Lobby Canada

Carbon Tax Pros And Cons Economics Help

Claims That Carbon Pricing Will Lead To Skyrocketing Price Increases Throughout The Economy Are Misplaced At Best And Misleading Carbon Economy Price Increase

Climate Income A K A Carbon Fee And Dividend Citizens Climate Lobby Canada

Climate Income A K A Carbon Fee And Dividend Citizens Climate Lobby Canada

Climate Income A K A Carbon Fee And Dividend Citizens Climate Lobby Canada

The Carbon Tax For Dummies Why Do We Need It And What Will We Pay Greenhouse Gases Energy Conservation Greenhouse Gas Emissions

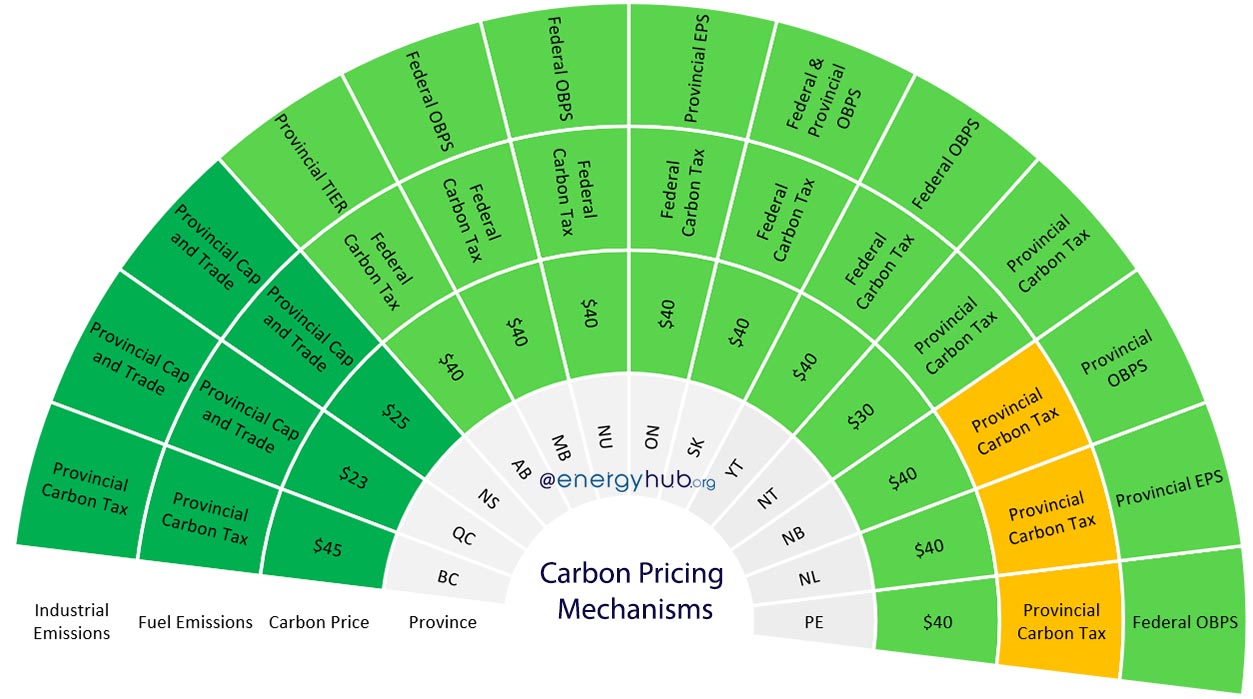

Your Cheat Sheet To Carbon Pricing In Canada Delphi Group

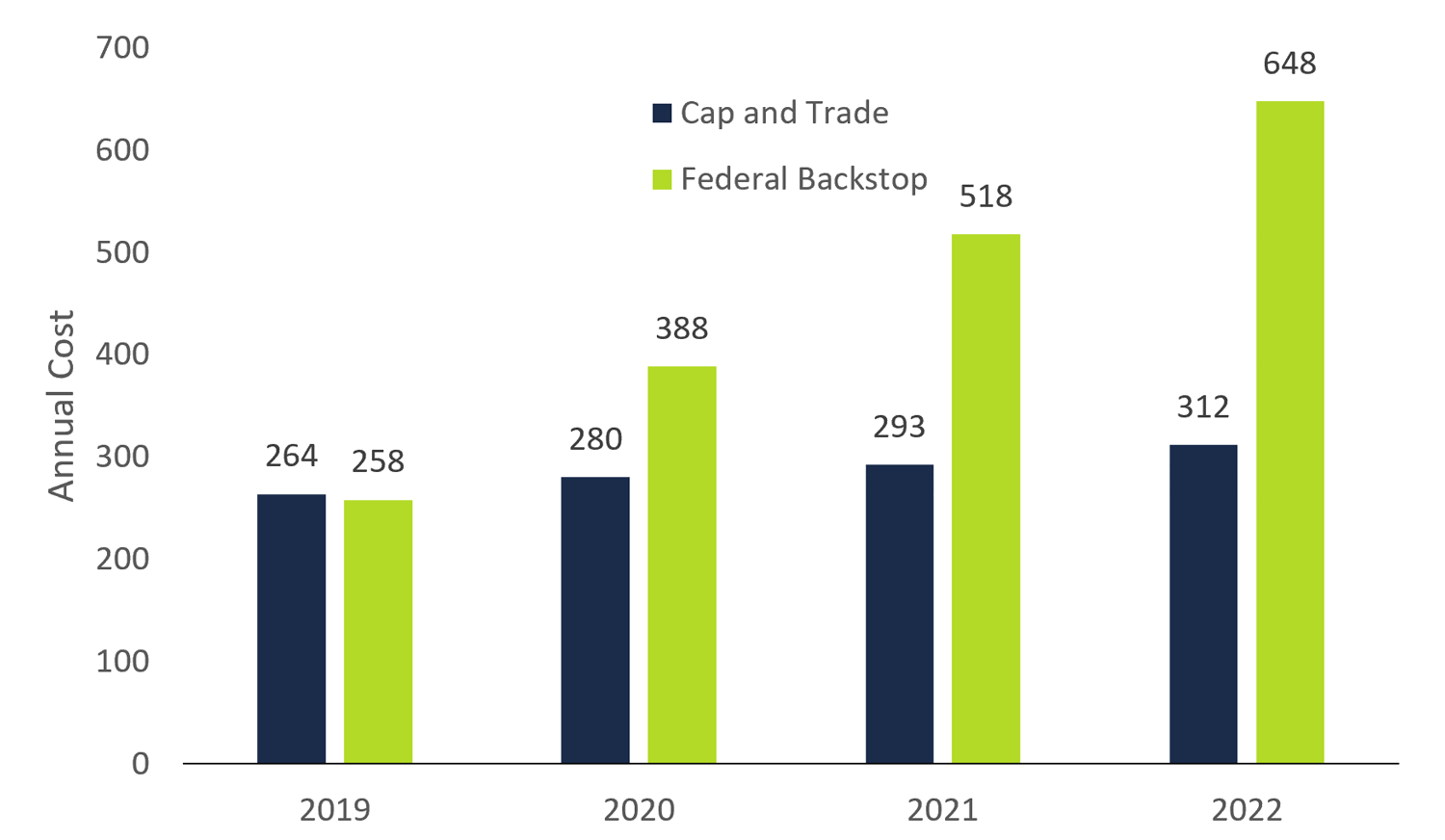

Cap And Trade A Financial Review Of The Decision To Cancel The Cap And Trade Program

Breakthrough Strategic Transportation Solution Provider

Where Carbon Is Taxed Overview

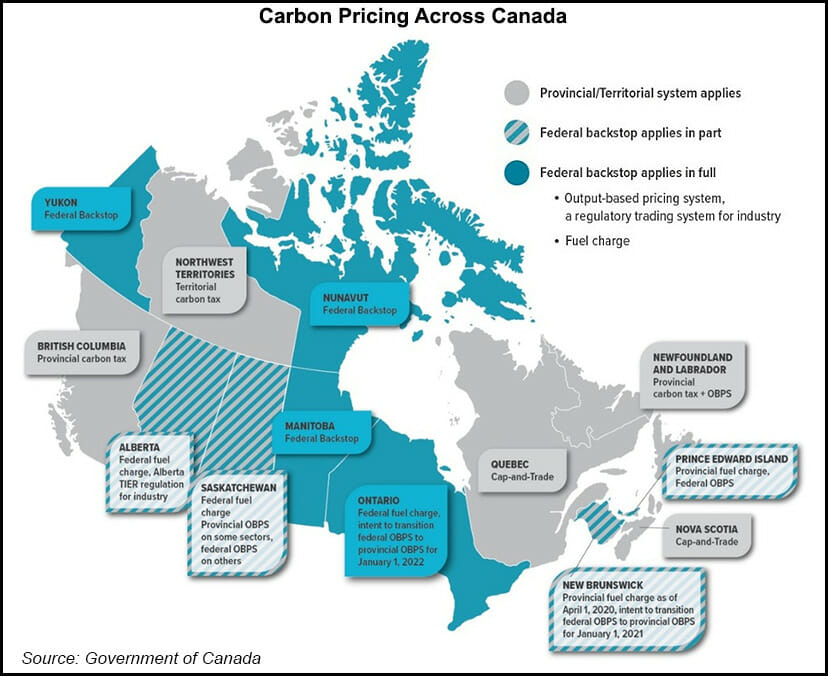

Canada S Scheduled Carbon Tax Increases Said To Pose Implementation Risk Natural Gas Intelligence

Dear Corporate Canada It S Time To Pay For Your Part In Climate Change Guardian Sustainable Business The Guardian

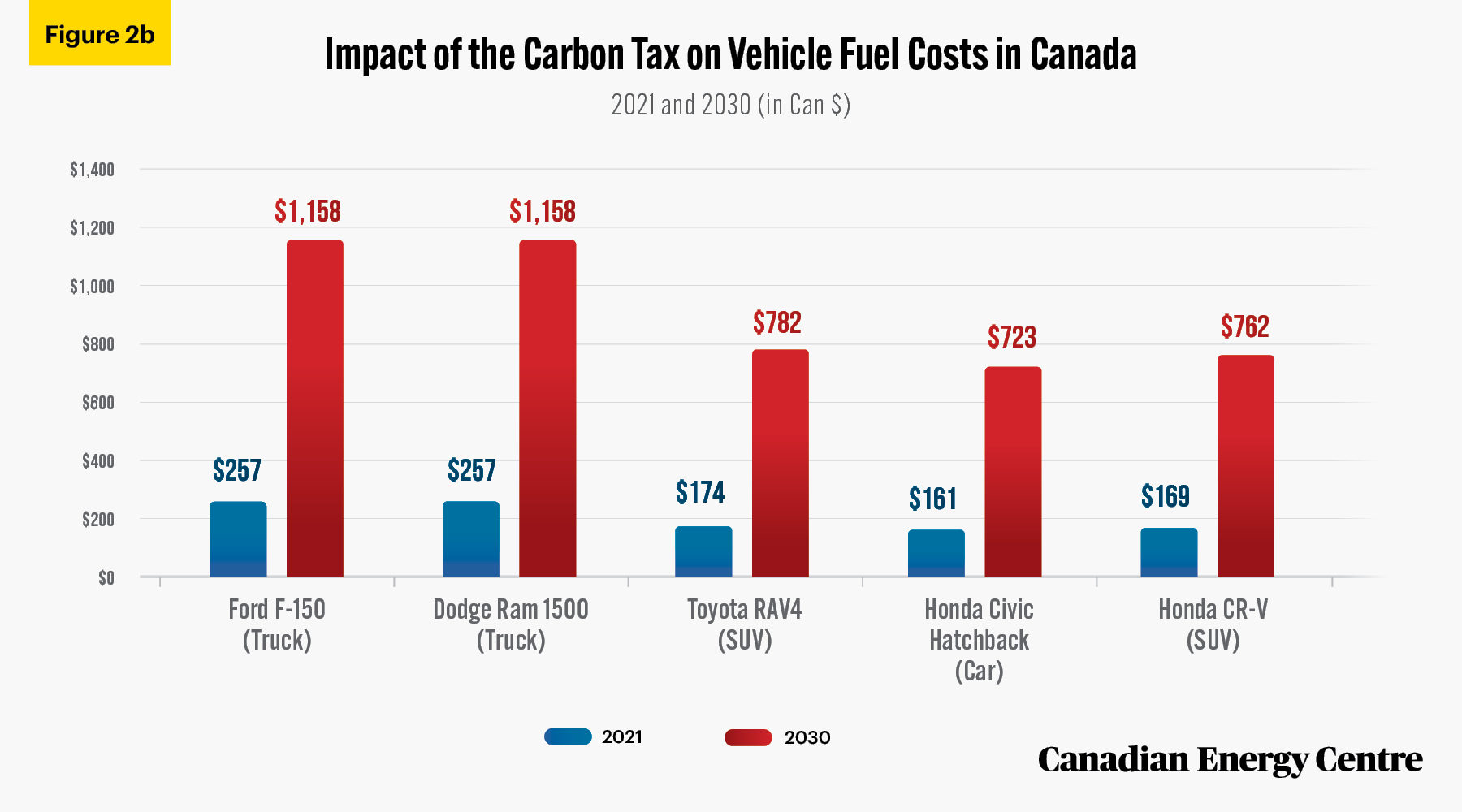

Up To 350 Per Cent Higher At The Pump By 2030 The Impact Of Higher Carbon Taxes On Gasoline Prices Canadian Energy Centre

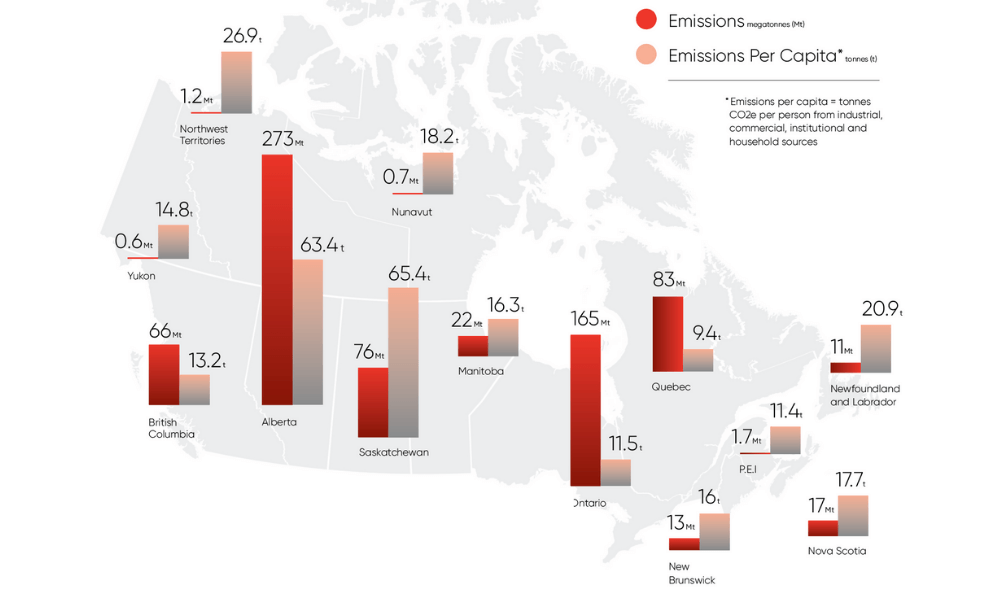

Estimated Impacts Of The Federal Carbon Pollution Pricing System Canada Ca

Federal Government S Carbon And Greenhouse Gas Legislation Canada

Estimated Impacts Of The Federal Carbon Pollution Pricing System Canada Ca

Net Zero Report Card How Future Friendly Are Canadian Provinces Corporate Knights